- ProductsSearch and BrowseRecommendationsCustomer Engagement

Black Friday ≠ Cyber Monday: Rethink your 2025 strategy

Black Friday and Cyber Monday are the cornerstones of the holiday shopping season, driving billions in revenue each year. While they are often mentioned together, they are distinct events, each with its own audience, product focus, and merchandising strategies. For ecommerce leaders, understanding these differences is crucial for maximizing conversions, managing inventory, and delivering a seamless customer experience.

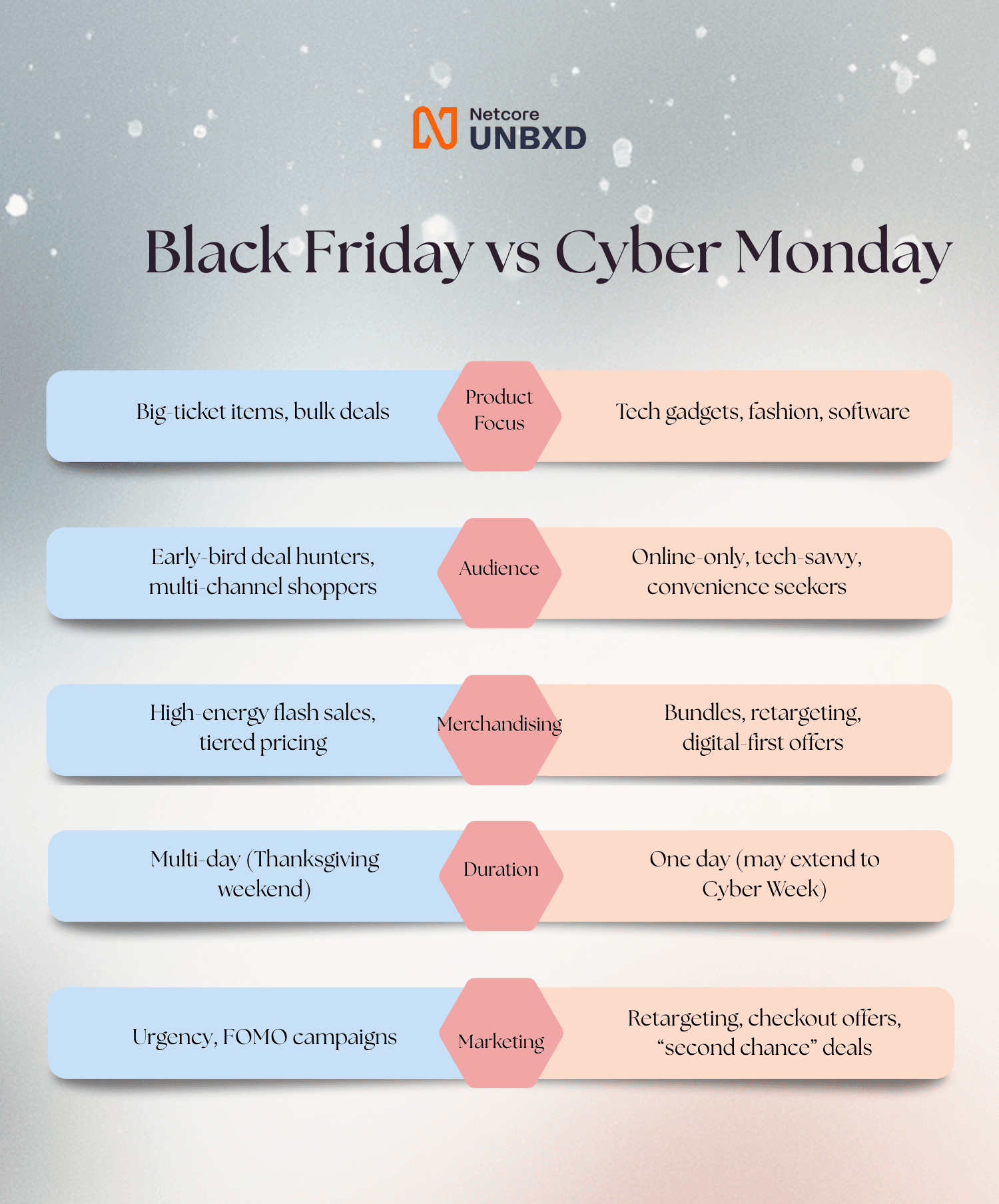

Understanding the core differences

At first glance, Black Friday and Cyber Monday might seem like two sides of the same coin, but their distinctions are important for shaping strategy.

Black Friday began as a brick-and-mortar tradition tied to Thanksgiving weekend. Today, it is a hybrid event, blending in-store and online shopping, with a particular focus on high-value items such as electronics, appliances, and home furnishings. In 2024, Adobe’s Digital Economy Index reported that U.S. ecommerce sales on Black Friday reached $11.6 billion, with significant traffic driven by early-bird shoppers hunting for big-ticket deals.

Cyber Monday, on the other hand, is a fully digital affair. It caters to convenience-driven, tech-savvy shoppers who are often looking for gadgets, fashion, software, and smaller impulse-friendly items. Adobe’s holiday shopping report 2025 predicts a record $253.4 billion will be spent online this holiday season (Nov 1–Dec 31), up 5.3% year-on-year. Daily online spend will hit its 2025 peak on Cyber Monday at $14.2B.

Another key distinction lies in duration. Black Friday has evolved into a multi-day event, sometimes stretching into a complete “Black Friday Week,” allowing retailers to stagger deals and keep customers engaged. Cyber Monday remains largely a single-day event, though many brands now extend offers into Cyber Week to capture late buyers and retarget shoppers who abandoned their carts.

Finally, the merchandising focus differs. Black Friday thrives on high-margin, high-value products using flash sales, tiered pricing, and limited-time offers. Cyber Monday shifts the focus to online-friendly items like smaller gadgets, digital bundles, and software subscriptions, where retargeting and second-chance promotions are more effective.

Partnering with a product discovery platform that can handle surging traffic volumes and maintain 99.99% uptime ensures that even during peak holiday hours, your customers enjoy frictionless experiences while your team focuses on strategy, not site stability.

Preparing for Black Friday and Cyber Monday

Success on these peak shopping days doesn’t happen by chance. It requires months of preparation, careful planning, and data-driven decisions.

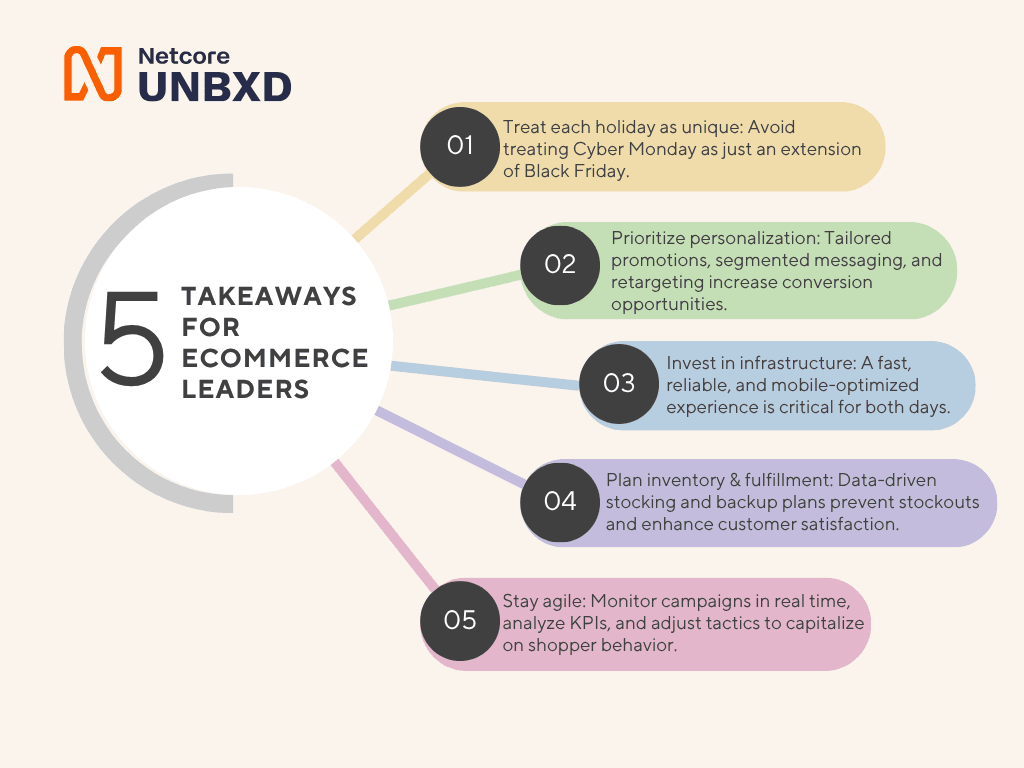

1. Start early & analyze data

Preparation should begin in early fall. Start by reviewing historical sales, customer behavior, and market trends to identify winning products and emerging opportunities.

Once insights are clear, focus on catalog enrichment should be the foundation of every successful holiday strategy. A complete, accurate, and well-tagged catalog powers better product discovery, personalization, and conversions. Poor catalog quality can derail even the best campaigns, leading to broken filters, irrelevant search results, and lost revenue during peak traffic.

With a strong catalog and clean data, AI-driven merchandising platforms can forecast demand more accurately, highlight high-intent shoppers, and recommend dynamic pricing or bundles. Clear goals like raising Black Friday AOV or Cyber Monday conversions keep teams aligned and performance measurable.

2. Segment, personalize & merchandise strategically

Black Friday

Segment audiences based on loyalty, purchase history, and engagement levels. VIP customers can access early deals, first-time buyers might receive introductory incentives, and bulk-buy discounts can drive higher revenue. Promotions should focus on high-ticket items, flash deals, and tiered pricing to create urgency. Logistics and inventory planning are critical to avoid stockouts during high-volume periods.

Cyber Monday

Here, the priority shifts to convenience and online usability. Streamlined checkout, mobile optimization, and fast-loading product pages are essential. Bundle offers, digital products, and flash deals drive impulse purchases. Retargeting campaigns for shoppers who abandoned carts during Black Friday can capture incremental revenue.

Platforms like Netcore Unbxd help merchandisers personalize experiences in real time, showing the right product, at the right price, to the right shopper, driving up conversions across both shopping days.

3. Optimize website & marketing channels

A fast, resilient, and discoverable website is essential. Every millisecond of delay costs potential sales.

Perform technical audits on:

- Page speed and mobile responsiveness

- Search relevance and product ranking

- Load capacity and hosting redundancy

Start marketing teasers early. Use SMS, email, and social media campaigns to build anticipation with countdown timers, early-access codes, and “sneak peek” deals.

With Netcore Unbxd’s intelligent site search and merchandising tools, brands can ensure shoppers instantly find the most relevant results, even during peak traffic, reducing bounce rates and increasing revenue.

4. Inventory planning & fulfillment

Out-of-stock messages during Black Friday or Cyber Monday can instantly erode trust. Smart inventory management backed by automation and predictive analytics is key.

Best practices include:

- Maintaining buffer inventory for best-selling SKUs

- Setting automated low-stock alerts

- Pre-integrating with logistics providers for faster shipping

AI-powered inventory and merchandising systems can recommend real-time product substitutions or alternative bundles when items run out, protecting revenue while maintaining shopper satisfaction.

5. Retarget, measure, and refine

Cyber Monday is the perfect opportunity to retarget Friday’s traffic. Cart abandoners, wish-list adders, and repeat visitors represent high-intent audiences.

Track metrics such as conversion rate, session duration, AOV, and ad performance in real time and adjust campaigns dynamically. Personalized retargeting messages with exclusive deals often drive impressive ROI.

Leveraging a unified product discovery and personalization platform helps synchronize campaigns across channels so every follow-up feels contextual, not repetitive.

By understanding the unique dynamics of Black Friday and Cyber Monday, ecommerce leaders can maximize revenue, strengthen customer loyalty, and create a seamless holiday shopping experience.