- ProductsSearch and BrowseRecommendationsCustomer Engagement

The 2025 BFCM trends and how Netcore Unbxd will power retail's growth in 2026 with AI!

The 2025 holiday season marks a turning point where machine customers driving discovery officially became the primary engine of ecommerce performance — not traffic, not promotions, not logistics.

According to BrightEdge, direct referrals from AI engines (such as chatbots and AI-powered search assistants) to ecommerce brands surged 752% year-over-year in the 2025 holiday season.

This year, Netcore Unbxd saw zero downtime, handled +50% more traffic, and achieved 20% YoY growth in conversion rates across our hero verticals, such as furniture, electronics, and fashion.

But the deeper story isn’t that “the numbers improved.”

The story is why they improved—and what these shifts tell us about the direction of retail in 2026 and beyond.

Key Takeaways

-

Netcore Unbxd has become the AI backbone for enterprise discovery, driving 20% higher site search conversion rates than the previous year.

-

Loyalty accelerated — repeat customers became the growth engine, increasing cart size by 2X compared to the BFCM week 2024.

-

Repeat shoppers reduced their time-to-order by nearly 8%, indicating that AI-led relevance matched their intent accurately.

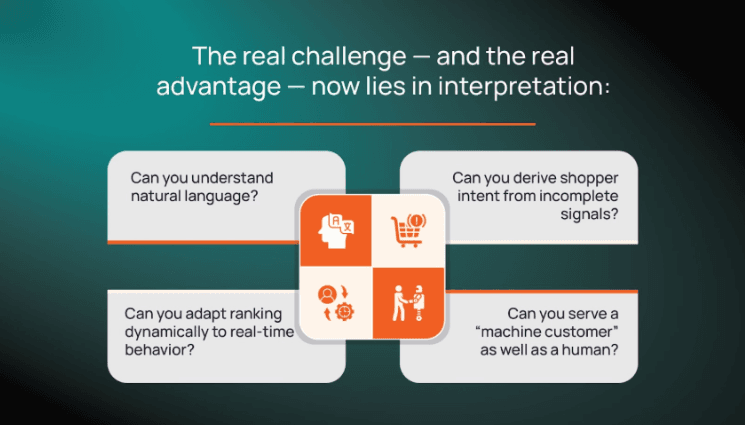

The real challenge and the real advantage- now lies in interpretation:

The shift in how shoppers interact with brands proves that if retailers’ ecommerce is not addressing the advanced challenges, they are already behind.

Netcore Unbxd’s 20% YoY improvement in conversion rate tells the market's progression story.

The most significant driver was the rise of context-rich sessions that began with stronger semantic understanding — and these sessions delivered meaningfully higher RPV.

When the system can interpret intent from the very first query, shoppers (and their AI assistants) move through the funnel with far less friction.

Our observations of repeat shopper behavior reinforce this. Returning users, who carry the richest contextual signals, not only converted faster but also doubled their cart sizes compared to last year.

That kind of lift comes from AI-led relevance that accurately interprets intent, recalls behavioral patterns, and reduces cognitive load at every step.

Even though traffic spikes are predictable, shopper intent is not.

Retail is no longer uniform; vertical segmentation is becoming increasingly evident.

The traditional assumption that “holiday traffic lifts all retail categories” broke this year.

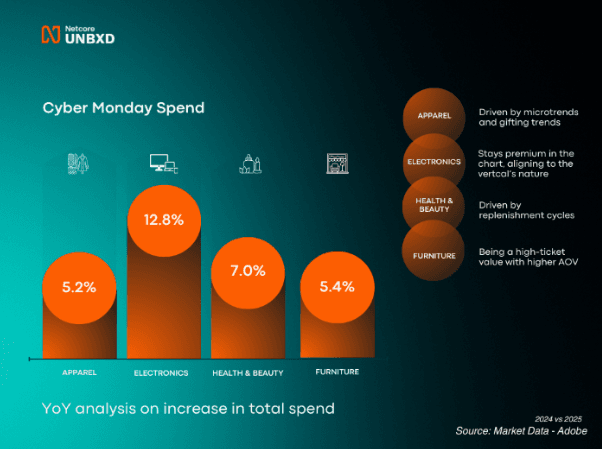

Vertical-Level increase in spend

While sectors like Apparel (+5.2%), Beauty (+7.0%), Furniture (+5.4%), and Electronics (+12.8%) all saw growth, the significant variance in their performance highlights that a "one-size-fits-all" outcome is a thing of the past.

Consequently, the real competitive advantage no longer comes from simply riding a wave of traffic but from the sophisticated interpretation of shopper data—the ability to understand natural language, derive intent from incomplete signals, and adapt dynamically to real-time behavior.

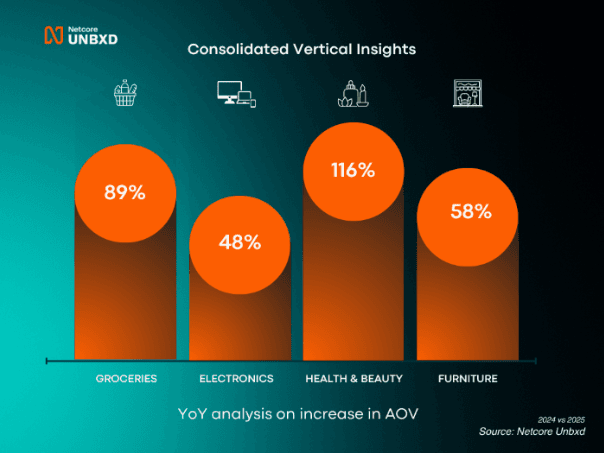

Vertical-Level shifts in AOV

As shopper journeys become increasingly AI-assisted, the way customers build carts is shifting from isolated product selection to intent-driven, multi-item purchase flows. This makes Average Order Value (AOV) and basket size growth essential indicators of whether a retailer’s discovery experience is truly resonating with shoppers' needs.

The chart below highlights how this played out across key verticals, showing where shoppers demonstrated the strongest purchase intent during Holiday 2025.

Insights for the 2025 holiday season

Food & Groceries: Shoppers are increasingly treating online groceries as a place for bundled purchases, bulk replenishments, and seasonal gifting baskets rather than single-item top-ups.

Health & Beauty: The surge shows that AI-powered discovery aligns with how beauty shoppers think, their multi-step decision process, and preference-based results.

Electronics: Strong performance indicates seamless semantic understanding of technical queries and accurate attribute matching.

Furniture & Home Improvement: Enhanced understanding of spatial intent, reducing friction in high-value decision paths.

Loyalty effect: Returning shoppers drove outsized gains

Netcore Unbxd retailers, this BFCM year saw site traffic rise 2X YoY, with repeat buyers driving much of the lift. Cart sizes from repeat customers also grew 2X compared to last year (outpacing those of new buyers).

Repeat shoppers reduced their time-to-order by up to 8%, indicating better AI-led relevance matched their intent accurately.

Rise of the machine customer

Last year, only 11% shoppers used generative AI for holiday shopping. This year, over 30% of shoppers are considering using AI for their wish lists.

Global AI-influenced sales reached $14.2B, with $3B from the U.S.

Machine shoppers are clearly becoming a meaningful share of holiday traffic, and their growing presence is beginning to reshape how product discovery works.

Unlike traditional shoppers who browse, compare, and refine their queries manually, machine-assisted shoppers arrive with clearer intent and rely on AI to interpret their needs, narrow options, and guide their decision-making.

This naturally leads to faster funnel progression and a higher likelihood of landing on relevant products without unnecessary friction. It also means retailers must optimize for interactions that begin with context rather than keywords.

Platforms that focus solely on human interaction patterns are lagging, as machine shoppers or machine-assisted shoppers exhibit distinct shopping behaviors and seek signals in product catalogs differently.

Netcore Unbxd’s rise in Shopping Agent usage is a preview of how ecommerce will function in 2026 and beyond.

Our platform-wide YoY analysis shows a decisive shift:

-

Retailers experienced higher conversion efficiency even when overall traffic didn’t spike at the same pace.

-

Sessions that began with AI-driven semantic understanding produced meaningfully higher RPV, signaling an industry shift toward relevance-first discovery.

-

Shoppers gravitated toward experiences that quickly clarified options and removed cognitive load — turning intent into purchases faster.

This year’s gains weren’t the result of more shoppers. They were the result of better-qualified shopper journeys.

Netcore Unbxd’s 20% YoY conversion lift — across RPV, AOV, and search-led sales — highlights how it has helped global retailers dominate this holiday season.

Reliability as holiday traffic scales

As generative AI, agentic shopping flows, and multi-step discovery journeys become standard in ecommerce, the operational burden on platforms has grown dramatically.

Retailers should not assess systems based solely on feature checklists; they need to evaluate if those systems can remain predictable, resilient, and capable of handling high-throughput workloads under AI-scale demands.

Many retailers across the ecosystem experienced intermittent service disruptions, slowdowns, and platform-level instability during the peak window, when even a few seconds of downtime can translate directly into abandoned carts and revenue loss.

In that environment, platform reliability became a front-line revenue metric, not a backend consideration.

Against this backdrop, Netcore Unbxd delivered 100% uptime throughout the BFCM week, even as traffic volumes surged by +50% YoY.

That level of resilience is becoming table stakes for retailers whose discovery, personalization, and agentic engines all depend on uninterrupted, low-latency performance.

Retailers increasingly choose platforms not for breadth of features but for the assurance that their AI-driven experiences will stay online, responsive, and stable when demand peaks.

How agentic commerce will define the 2026 holiday season

Machine customers and the Shopping Agent have already begun reshaping how shoppers engage with brands. What started as conversational search and guided product queries is now evolving into fully agentic shopping journeys, where AI does the heavy lifting on behalf of the shopper.

This shift is happening because shoppers increasingly expect digital experiences that behave like a knowledgeable human assistant: proactive, contextual, and capable of handling multi-step tasks without requiring the shopper to micromanage each step. Traditional search engines and rule-based personalization simply cannot meet that expectation.

What retailers must do to prepare for this future

To thrive in 2026, retailers must evolve from optimizing pages to optimizing agent-compatible ecosystems. That means:

-

Structuring product data so agents can interpret attributes, constraints, compatibility, and trade-offs.

-

Adopting real-time, semantic discovery systems capable of reasoning about intent rather than matching keywords.

-

Supporting multi-step task execution, where an agent can compare, filter, bundle, validate, and recommend without human intervention.

-

Building experiences that allow AI to personalize proactively, not reactively—anticipating needs across every touchpoint.

-

Reducing friction at every stage, enabling agents to seamlessly move shoppers from intent to checkout.

The New Leader in Agentic Commerce: Netcore Unbxd

The shifts we observed this BFCM season- the rise of machine-assisted shoppers, stronger semantic-first journeys, expanding basket sizes, and faster decision-making among repeat customers- form the foundation for the next era of ecommerce: agentic commerce.

These changes are not theoretical; they are already reshaping how shoppers interact with retailers and how retailers must design their discovery experiences.

Our platform delivered 20% YoY growth in conversion, supported larger repeat-customer cart sizes, maintained 100% uptime, and enabled retailers to handle surging traffic without compromising relevance or responsiveness. Every one of these gains is tied to the same underlying capability: the ability to interpret intent accurately and support context-rich discovery paths.

In 2026, retailers will need autonomous AI engines that operate as true shopping agents, not just tools. Netcore Unbxd is already empowering this future.